Last Updated by Akash Biswas: 11 January 2026

Medicare eligibility in 2026 starts at age 65 for most people. You can also qualify earlier if you have a disability, end-stage renal disease, or ALS.

You must be a U.S. citizen or legal resident who lived here for 5 years.

Quick Summary:

- Age 65 or older is the standard eligibility age

- You need 40 work quarters (10 years) for free Part A

- Disability, ESRD, and ALS allow early enrollment

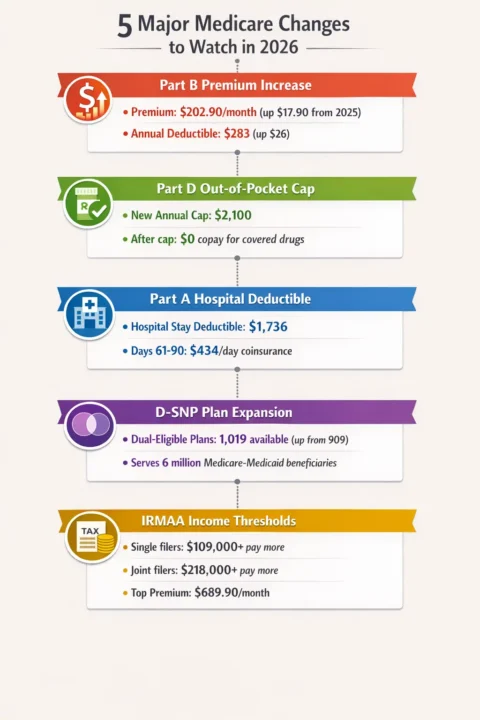

- Part B premium is $202.90 per month in 2026

- Enrollment periods prevent coverage gaps and penalties

- Spousal work history can qualify you for benefits

Please look at this infographic, where you will see the five major changes to Medicare in 2026:

Who Qualifies for Medicare in 2026?

You must meet basic requirements to get Medicare coverage.

Age and Citizenship Rules

You qualify for Medicare if you are 65 years or older. You must also be a U.S. citizen or legal permanent resident. Legal residents must live in the U.S. for at least 5 years before applying.

Turning 65 does not automatically enroll you. You must also meet work history requirements or qualify another way.

Work Credit Requirements

Most people get free Medicare Part A through work credits. You need 40 quarters of coverage. That equals 10 years of work where you paid Medicare taxes.

About 99% of Medicare users get free Part A this way.

If you have fewer work credits:

- 30-39 quarters: Pay $311 per month for Part A

- Under 30 quarters: Pay $565 per month for Part A

Source: CMS 2026 Medicare Costs

Qualifying Through Your Spouse

You can use your spouse’s work record to qualify. Here’s how:

Current marriage: You’ve been married at least 12 months. Your spouse must be eligible for Social Security benefits.

Divorced: You were married at least 10 years. Your ex-spouse qualifies for Social Security. You can be divorced any length of time.

Widowed: You were married at least 9 months before your spouse died. Your spouse qualified for Social Security benefits.

These rules help people who never worked or didn’t work enough years.

Early Medicare Eligibility (Before Age 65)

Three medical conditions let you enroll before turning 65.

Social Security Disability Insurance (SSDI)

You qualify after receiving SSDI for 24 months. Your disability must prevent you from working. It must be expected to last at least one more year.

Medicare enrollment happens automatically once you hit 24 months of SSDI.

End-Stage Renal Disease (ESRD)

Kidney failure qualifies you for Medicare at any age. You must meet one of these conditions:

- You worked enough quarters under Social Security

- You receive or qualify for Social Security benefits

- You’re the spouse or child of someone who meets these rules

When coverage starts:

- Month 3 after dialysis begins

- Month 1 if you do self-dialysis at home

- Month of kidney transplant

- Two months before transplant if hospitalized for preparation

Source: Medicare ESRD Coverage

Amyotrophic Lateral Sclerosis (ALS)

ALS has no waiting period. You get Medicare the same month you qualify for Social Security disability benefits.

This is the fastest Medicare eligibility pathway.

Medicare Part A Costs in 2026

Part A covers hospital stays and skilled nursing care.

Premiums

Most people pay $0 per month for Part A. If you must buy Part A:

- $311/month with 30-39 work quarters

- $565/month with under 30 work quarters

Out-of-Pocket Costs

| What You Pay | 2026 Amount |

|---|---|

| Hospital deductible (first 60 days) | $1,736 |

| Days 61-90 in hospital | $434 per day |

| Lifetime reserve days | $868 per day |

| Skilled nursing (days 21-100) | $217 per day |

You pay these costs even with free Part A. Consider getting a Medigap plan to help cover these gaps.

Medicare Part B Costs in 2026

Part B covers doctor visits and outpatient services.

Standard Premium and Deductible

The monthly premium is $202.90 in 2026. This is $17.90 higher than 2025.

The annual deductible is $283. After meeting your deductible, you pay 20% of Medicare-approved costs.

Source: 2026 Medicare Premiums

High-Income Surcharges (IRMAA)

You pay extra if your income is high. These amounts are based on your tax return from 2 years ago.

| Your Income (Single) | Your Income (Married) | Total Monthly Premium |

|---|---|---|

| $109,000 or less | $218,000 or less | $202.90 |

| $109,001-$137,000 | $218,001-$274,000 | $284.10 |

| $137,001-$171,000 | $274,001-$342,000 | $405.80 |

| $171,001-$205,000 | $342,001-$410,000 | $527.50 |

| $205,001-$499,999 | $410,001-$749,999 | $649.20 |

| $500,000 or more | $750,000 or more | $689.90 |

IRMAA applies to Part B and Part D plans.

Medicare Part C (Medicare Advantage) in 2026

Medicare Advantage plans replace Original Medicare Parts A and B.

Who Can Enroll

You must meet three requirements:

- Be eligible for Medicare (age 65+ or qualifying condition)

- Have both Part A and Part B

- Live in the plan’s service area

Medicare Advantage plans often include extra benefits like dental care, vision care, hearing aids, and gym memberships.

Plan Availability

About 99.4% of Medicare beneficiaries can access at least one Medicare Advantage plan. Urban areas average 42 plan choices. Rural areas have fewer options.

Some rural counties have no Medicare Advantage plans available.

Source: KFF Medicare Advantage Analysis

Plan Types

- HMO: Lower costs but must use network doctors

- PPO: More flexibility to see out-of-network doctors

- Special Needs Plans: For people with specific conditions

- PFFS: Choose any Medicare provider who accepts the plan

- MSA: High-deductible plan with savings account

Medicare Part D (Prescription Drugs) in 2026

Part D helps pay for medications.

Costs and Coverage

| Cost Type | 2026 Amount |

|---|---|

| Maximum deductible | $615 |

| Your share after deductible | 25% |

| Out-of-pocket cap | $2,100 |

| Cost after cap | $0 |

Once you spend $2,100 out of pocket, you pay nothing for covered drugs the rest of the year.

How Coverage Works

Stage 1 – Deductible: You pay 100% until you meet your plan’s deductible.

Stage 2 – Initial Coverage: You pay 25% of drug costs until your out-of-pocket spending hits $2,100.

Stage 3 – Catastrophic Coverage: You pay $0 for covered drugs after reaching $2,100.

This new structure saves money for people with high drug costs.

Source: Medicare Part D Changes

Protected Drug Classes

All Part D plans must cover at least 2 drugs per category. They must cover all drugs in these 6 protected classes:

- Immunosuppressants (organ transplant)

- Antiretrovirals (HIV/AIDS)

- Antidepressants

- Antipsychotics

- Anticonvulsants (seizures)

- Antineoplastics (cancer)

Medicare Supplement (Medigap) Plans

Medigap plans help cover costs Original Medicare doesn’t pay.

What You Need to Know

You cannot have both Medigap and Medicare Advantage. Choose one or the other.

Medigap covers deductibles, coinsurance, and copayments. It works alongside Original Medicare Parts A and B.

Available Plans in 2026

Plans include A, B, D, G, K, L, M, and N. Plan F is only available if you qualified for Medicare before January 1, 2020.

Plan G is the most popular. It covers everything except the Part B deductible ($283 in 2026).

Plans K and L have out-of-pocket limits:

- Plan K: $8,000 yearly maximum

- Plan L: $4,000 yearly maximum

After hitting these limits, the plan pays 100% of covered costs.

Source: Medicare Medigap Benefits

Medicare Enrollment Periods 2026

Missing enrollment deadlines can cost you money.

Initial Enrollment Period (IEP)

Your IEP is a 7-month window around your 65th birthday:

- 3 months before your birthday month

- Your birthday month

- 3 months after your birthday month

Coverage starts the month after you enroll. Sign up early to avoid gaps.

Annual Enrollment Period (AEP)

The 2026 enrollment period runs October 15, 2025 – December 7, 2025. Changes take effect January 1, 2026.

During AEP you can:

- Switch from Original Medicare to Medicare Advantage

- Change Medicare Advantage plans

- Switch back to Original Medicare

- Add, drop, or change Part D plans

Medicare Advantage Open Enrollment

If you’re already in Medicare Advantage, you get another chance to change plans.

January 1 – March 31, 2026

You can make one change during this period. Switch to another Medicare Advantage plan or return to Original Medicare.

General Enrollment Period (GEP)

Missed your IEP? You can enroll during GEP.

January 1 – March 31 each year

Coverage begins the month after you enroll. You will pay late enrollment penalties.

Special Enrollment Periods

Certain life events trigger special enrollment:

- Loss of employer health coverage

- Moving outside your plan’s service area

- Loss of Medicaid coverage (6 months to enroll)

- Release from incarceration (12 months to enroll)

- Disaster or emergency declaration

Source: Medicare Enrollment Guide

Late Enrollment Penalties

Penalties last for years or even permanently.

Part A Penalty

Your premium increases by 10% for twice the number of years you delayed enrollment.

Example: If you delay 2 years, you pay the penalty for 4 years.

Part B Penalty

You pay an extra 10% for each full 12-month period you were eligible but didn’t enroll.

This penalty is permanent. You pay it as long as you have Part B.

Part D Penalty

The penalty is 1% of the national average premium for each month you delay enrollment.

In 2025, that’s about $3.90 per month of delay. This penalty is also permanent.

Avoid penalties: Enroll during your Initial Enrollment Period or have creditable drug coverage from another source.

Special Medicare Coverage Situations

Some people have unique Medicare needs.

Immunosuppressive Drug Coverage

After a kidney transplant, Part B usually ends 36 months later. You can continue Part B just for immunosuppressive drugs.

The monthly premium is $121.60 for most people. Higher earners pay more based on income.

Dual Eligibility (Medicare and Medicaid)

About 6 million Americans qualify for both programs. These people can enroll in Dual-Eligible Special Needs Plans (D-SNPs).

In 2026, there are 1,019 D-SNP plans available nationwide. This is up from 909 plans in 2025.

D-SNPs coordinate Medicare and Medicaid benefits. They often have $0 premiums and extra benefits.

Check Medicaid eligibility 2026 by state to see if you qualify for both Medicare and Medicaid. Dual coverage can save you thousands in healthcare costs.

How to Apply for Medicare in 2026

You have several ways to enroll.

Application Methods

Online: Visit SSA.gov to apply anytime

Phone: Call 1-800-772-1213 (TTY: 1-800-325-0778)

In person: Visit your local Social Security office

By mail: Complete form CMS-18-F-5 for Part A and B

What You Need

Gather these documents before applying:

- Social Security number

- Birth certificate or proof of age

- Proof of U.S. citizenship or legal residency

- Work history information

- Current health insurance information

The Social Security Administration handles Medicare enrollment. Contact them 3 months before your 65th birthday.

For more help, visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227).

Frequently Asked Questions (FAQ)

Can I get Medicare if I never worked?

Yes. You can qualify through your spouse’s work record if married for 12 months, divorced after 10 years of marriage, or widowed after 9 months. You’ll pay $311-$565 monthly for Part A if you have no work credits.

What is the Medicare eligibility age in 2026?

The standard eligibility age is 65 years old. You can qualify earlier if you receive SSDI for 24 months, have end-stage renal disease, or are diagnosed with ALS (no waiting period required).

How much does Medicare cost in 2026?

Part A is free for most people. Part B costs $202.90 per month with a $283 annual deductible. High earners pay $284-$690 monthly for Part B. Part D and Medigap costs vary by plan.

When should I enroll in Medicare?

Enroll during your Initial Enrollment Period (3 months before through 3 months after your 65th birthday). Late enrollment causes permanent penalties on Part B and Part D premiums.

What’s the difference between Medicare Advantage and Original Medicare?

Original Medicare (Parts A and B) is run by the government. Medicare Advantage (Part C) is offered by private insurers and often includes extra benefits like dental and vision care. You cannot have both simultaneously.

Do I need both Medicare and Medicaid?

If you qualify for both, Medicaid helps pay Medicare premiums and out-of-pocket costs. About 6 million Americans have dual eligibility. Dual-Eligible Special Needs Plans (D-SNPs) coordinate both programs for better coverage.

About the Author

My name is Akash Biswas. I like to read hard government rules and make them easy to understand. Many people find Medicaid and Medicare confusing, and that is okay. I want to help.

I made this website so families can learn in simple words. I take big, hard information and break it into small, easy steps. I want every person to feel calm and sure when they read about Medicaid or Medicare.

My goal is to help you understand who can get help, how to apply, and what to do next. I hope this website makes your life easier and helps you get the care you need.

I study Medicaid and Medicare rules every day and work hard to share clear, correct, and easy information for all families.

Sources:

- Centers for Medicare & Medicaid Services (CMS)

- Social Security Administration (SSA)

- Medicare.gov Official Resources

- KFF Medicare Analysis Reports