Last Updated: November 10, 2025

Review by Akash Biswas (United States Government Benefits Expert Researcher)

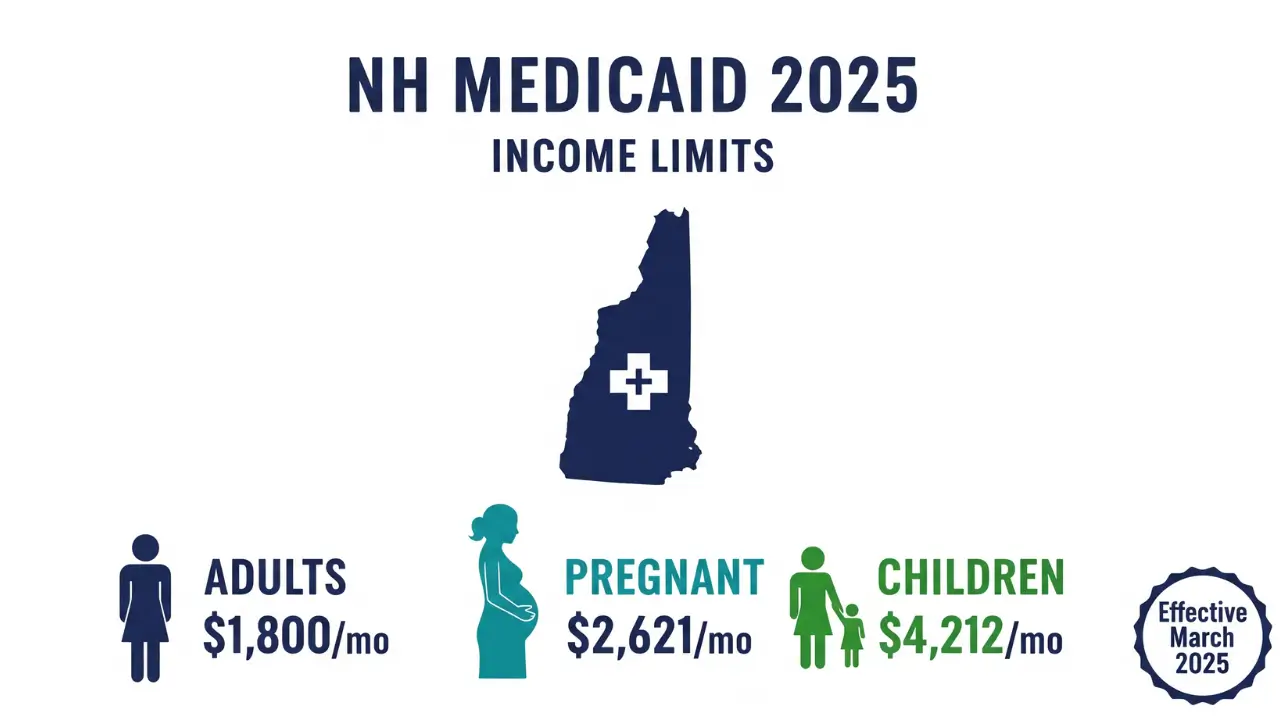

New Hampshire Medicaid provides healthcare coverage to eligible residents based on income and household size.

Income limits vary by category: adults ages 19-64 qualify at 138% of the federal poverty level, pregnant women at 201%, and children up to age 18 at 323% of FPL.

Quick Facts:

- Adults must have income at or below 138% of FPL (Granite Advantage)

- Pregnant women qualify at 201% of FPL with 12 months postpartum coverage

- Children ages 0-18 qualify at 323% of FPL

- No asset test for MAGI-based programs in New Hampshire

- Income limits became effective March 1, 2025

- Copayments capped at $147 per quarter for eligible enrollees

Check your eligibility using the NH Medicaid eligibility calculator or learn more about Medicaid income limits 2025 by state.

What Are NH Medicaid Income Limits?

NH Medicaid (Medical Assistance) uses Modified Adjusted Gross Income (MAGI) rules to determine eligibility for most programs. These rules use IRS tax filing concepts to determine household size and countable income.

Income limits are based on the federal poverty level (FPL). For 2025, 100% FPL equals $1,304 monthly for one person and $2,221 monthly for a family of three.

2025 NH Medicaid Income Limits by Category

Adults (Ages 19-64)

The Granite Advantage program covers adults with income at or below 138% of FPL (the statutory limit is 133% FPL, but a 5% MAGI-specific income deduction increases the effective limit to 138%). Here are the monthly limits:

| Household Size | Monthly Income Limit (138% FPL) |

|---|---|

| 1 person | $1,800 |

| 2 people | $2,432 |

| 3 people | $3,065 |

| 4 people | $3,697 |

| 5 people | $4,330 |

| 6 people | $4,962 |

| 7 people | $5,595 |

| 8 people | $6,227 |

Pregnant Women

Pregnant women qualify at 201% of FPL. Coverage continues for twelve months postpartum.

| Household Size | Monthly Income Limit (201% FPL) |

|---|---|

| 1 person | $2,621 |

| 2 people | $3,542 |

| 3 people | $4,464 |

| 4 people | $5,385 |

| 5 people | $6,307 |

| 6 people | $7,228 |

| 7 people | $8,150 |

| 8 people | $9,071 |

Children (Ages 0-18)

Children qualify at 323% of FPL.

| Household Size | Monthly Income Limit (323% FPL) |

|---|---|

| 1 person | $4,212 |

| 2 people | $5,694 |

| 3 people | $7,173 |

| 4 people | $8,653 |

| 5 people | $10,136 |

| 6 people | $11,616 |

| 7 people | $13,098 |

| 8 people | $14,579 |

Long-Term Care Medicaid Income Limits

For nursing home and waiver services, the income limit for an individual is $2,901 per month as of 2025. When only one spouse applies for Nursing Home Medicaid, only the applicant’s income is counted.

Asset Limits for Long-Term Care

Single applicants cannot have countable assets exceeding $2,500. For married couples, the community spouse can retain up to $157,920 in assets (Community Spouse Resource Allowance).

Spousal Protections

For married couples where one spouse needs long-term care, the community spouse is entitled to a Monthly Maintenance Needs Allowance (MMMNA) between $2,644 and $3,948 (effective July 1, 2025 through June 30, 2026).

The nursing home resident receives a Personal Needs Allowance of $90 per month.

How to Qualify for NH Medicaid

Who Can Apply?

You may qualify if you are:

- A New Hampshire resident

- A U.S. citizen or qualified immigrant

- An adult ages 19-64 with income at or below 138% FPL

- Pregnant with income at or below 201% FPL

- A child under age 18 with household income at or below 323% FPL

What Income Counts?

Nearly all income from any source counts toward Medicaid’s income limit. This includes employment wages, alimony, pension payments, Social Security Disability Income, IRA withdrawals, and stock dividends.

Supplemental Security Income (SSI) is not counted as income. In NH, the VA Aid & Attendance Allowance above the Basic VA Pension does not count.

How to Apply for NH Medicaid

Application Options

You can apply through these methods:

- Online: Visit NH EASY Gateway to Services at NHEasy.nh.gov

- Mail: Complete Form 800 and mail to your local DHHS office

- Phone: Call 1-844-275-3447 (844-ASK-DHHS)

- Healthcare.gov: Apply through the federal marketplace

Required Documents

Gather these documents before applying:

- Social Security numbers for all household members

- Proof of income (pay stubs, tax returns)

- Proof of residency

- Immigration status documents (if applicable)

- Bank statements

Processing Time

Processing typically takes 45 to 90 days depending on case complexity and coverage type.

Special Medicaid Programs in NH

Medicare Savings Programs

Qualified Medicare Beneficiaries (QMB): Must have monthly income at or below 100% FPL ($1,304 for one person, $1,763 for two people).

Specified Low-Income Medicare Beneficiaries (SLMB): Must have income between 101% and 120% FPL ($1,318-$1,565 for one person, $1,781-$2,116 for two people).

SLMB-135: Covers individuals with income between 121% and 135% FPL.

Qualified Disabled and Working (QDWI): For individuals with income at or below 200% FPL.

Medicaid for Employed Adults with Disabilities (MEAD/MOAD)

For MEAD and MOAD, individuals must have monthly net income at or below 250% FPL. With income disregards, eligibility can extend up to 450% FPL.

Income Limits (250% FPL):

- 1 person: $3,260

- 2 people: $4,406

- 3 people: $5,552

- 4 people: $6,700

With Income Disregards (450% FPL):

- 1 person: $5,869

- 2 people: $7,934

- 3 people: $9,995

- 4 people: $12,060

Family Planning Services

Family Planning Medical Assistance (FPMA) offers limited coverage for family planning services. Individuals must have income at or below 133% FPL and cannot be pregnant or already receiving Medicaid.

What If Your Income Is Too High?

If your income exceeds Medicaid limits, you have options:

Qualified Income Trusts

Qualified Income Trusts (Miller Trusts) allow applicants to redirect excess income to meet eligibility requirements for long-term care services.

Marketplace Premium Tax Credits

If income is between 100% and 400% of FPL, you may qualify for premium tax credits on Healthcare.gov plans.

Medicaid Spend Down

The Medicaid Spend Down program allows individuals to “spend down” excess income on medical expenses until reaching the eligibility threshold.

Copayments and Cost Sharing

Enrollees with incomes under 100% FPL are not charged copayments. For those with copayments, there is a quarterly limit of $147. Once you pay $147 in any three-month period, no additional copayments are required for that quarter.

Getting Help with Your Application

ServiceLink Resource Centers

New Hampshire’s aging and disability resource centers provide free information and assistance. Call 1-866-634-9412 to find your local office.

NH Legal Assistance

NH Legal Assistance offers legal services for seniors on healthcare access issues. Visit www.nhla.org or call 1-800-562-3174.

DHHS Customer Service

For questions about programs and application assistance, contact the DHHS Customer Service Center at 844-275-3447.

Frequently Asked Questions

How much can I make and still get Medicaid in NH?

For adults ages 19-64, you can earn up to $1,800 per month ($21,600 annually) as a single person or $3,697 per month for a family of four. Pregnant women can earn up to $2,621 monthly (single) or $5,385 (family of four). Children qualify with much higher income limits: up to $4,212 monthly for one child or $8,653 for a family of four. These limits are effective as of March 1, 2025.

Does my car or house count against Medicaid eligibility?

No, not for regular Medicaid coverage. New Hampshire does not have an asset test for adults, children, or pregnant women applying for standard Medicaid programs.

Your home, car, and savings accounts do not affect eligibility. Asset limits only apply if you’re applying for nursing home care or long-term care services (where the limit is $2,500 for single applicants).

I make $2,000 per month – can I still get Medicaid if I’m pregnant?

Yes. As a pregnant woman with income of $2,000 per month, you’re well within the $2,621 monthly limit for a single person (or higher if you have other household members).

Your coverage will continue for a full 12 months after your baby is born, giving you continuous healthcare coverage during pregnancy and postpartum recovery.

My parent needs nursing home care but gets $3,200/month in pension – are they disqualified?

Not necessarily. While the nursing home Medicaid income limit is $2,901 per month, your parent can establish a Qualified Income Trust (also called a Miller Trust) to redirect the excess $299 to meet eligibility requirements.

This is a common and legal planning strategy. Contact a Medicaid planning specialist or NH Legal Assistance at 1-800-562-3174 for help setting this up.

I work full-time making $3,500/month – does that automatically disqualify me from NH Medicaid?

It depends on your household size. If you’re single, $3,500 monthly exceeds the $1,800 adult limit. However, if you have a family of four, the limit is $3,697, so you’d qualify.

Having a job doesn’t disqualify you – only your total household income and size matter. If you’re slightly over the limit, you may qualify for subsidized health insurance through Healthcare.gov instead.

What happens to my Medicaid if I get a raise or new job?

You must report income changes to NH DHHS within 10 days. If your new income exceeds Medicaid limits, you’ll lose coverage, but you may qualify for subsidized marketplace insurance through Healthcare.gov.

You’ll have a Special Enrollment Period to sign up for a new plan within 60 days. If you receive a small raise that keeps you under the limit, your Medicaid continues uninterrupted.

Important Updates for 2025

Income limits were updated effective March 1, 2025, based on federal poverty guidelines published in the Federal Register on January 17, 2025 (90 FR 5917).

New Hampshire’s system (New HEIGHTS) automatically updated all reference tables with new income limits for eligibility periods beginning on or after March 1, 2025.

2025 Federal Poverty Level Reference (100% FPL)

| Household Size | Monthly | Annual |

|---|---|---|

| 1 person | $1,304 | $15,650 |

| 2 people | $1,763 | $21,150 |

| 3 people | $2,221 | $26,650 |

| 4 people | $2,680 | $32,150 |

| 5 people | $3,138 | $37,650 |

| 6 people | $3,597 | $43,150 |

| 7 people | $4,055 | $48,650 |

| 8 people | $4,514 | $54,150 |

| Each additional | +$459 | +$5,500 |

Official Resources

For the most accurate and up-to-date information, visit:

- NH DHHS Medicaid: www.dhhs.nh.gov/programs-services/medicaid

- Apply Online: NH EASY Gateway

- Healthcare.gov: www.healthcare.gov

- Federal Poverty Guidelines: ASPE.HHS.gov

Eligibility limits are subject to change. Always verify current information through New Hampshire DHHS.

This article provides general information about NH Medicaid income limits. Eligibility rules and income limits may change. For personalized assistance, contact NH DHHS or consult with a qualified benefits specialist.