Last updated by Akash Biswas: January 7, 2026

Accuracy Note (2026):

The information on this page reflects the most current federal guidance, SSI adjustments, and Federal Poverty Level data available for early 2026. Final Medicaid eligibility limits may be updated as states adopt official 2026 guidelines. This page will be updated promptly if federal or state rules change.

Quick Summary of 2026 Medicaid Financial Limits:

- Long-Term Care Income Cap: $2,982 / month (up from $2,901)

- Asset Limit (Most States): $2,000 (Individual)

- Community Spouse Asset Protection: Up to $162,660

- Home Equity Limit: $752,000 – $1,130,000 (depending on state)

What Changed for Medicaid Eligibility in 2026? Medicaid eligibility rules for 2026 have been updated to reflect the 2.8% federal Cost-of-Living Adjustment (COLA). While the core eligibility categories remain the same, the financial thresholds have shifted to help applicants keep pace with inflation.

Key 2026 Updates:

- Higher Income Limits: The income cap for nursing home Medicaid has risen to $2,982 per month (based on the new SSI rate of $994).

- Increased Spousal Protections: A spouse living at home can now retain up to $162,660 in assets (CSRA) without disqualifying their partner from care.

- Medicare Interaction: For those using “spend-down” to qualify, be aware that the Medicare Part B premium is now $202.90, and the Part D out-of-pocket drug cap is $2,100 for 2026.

What Changed for Medicaid Eligibility in 2026?

Medicaid eligibility rules for 2026 changed mainly due to federal cost-of-living adjustments (COLA) tied to Supplemental Security Income (SSI) and inflation.

These updates affect income limits, spousal protections, and long-term care eligibility thresholds.

Key changes for 2026 include:

- Higher income limits for long-term care Medicaid, with the monthly income cap increasing to $2,982

- Updated spousal impoverishment protections, allowing a spouse living at home to keep more income and assets

- Adjusted home equity limits for long-term care applicants, based on inflation

- Annual updates to Medicare Savings Program (MSP) asset limits, which help low-income Medicare beneficiaries pay premiums and cost-sharing

There were no major structural changes to how Medicaid eligibility is determined in 2026. Instead, the program continues to use the same eligibility categories, with updated financial limits that reflect rising living costs.

The next step in determining eligibility is understanding which Medicaid category applies to you, since income and asset rules differ significantly depending on that classification.

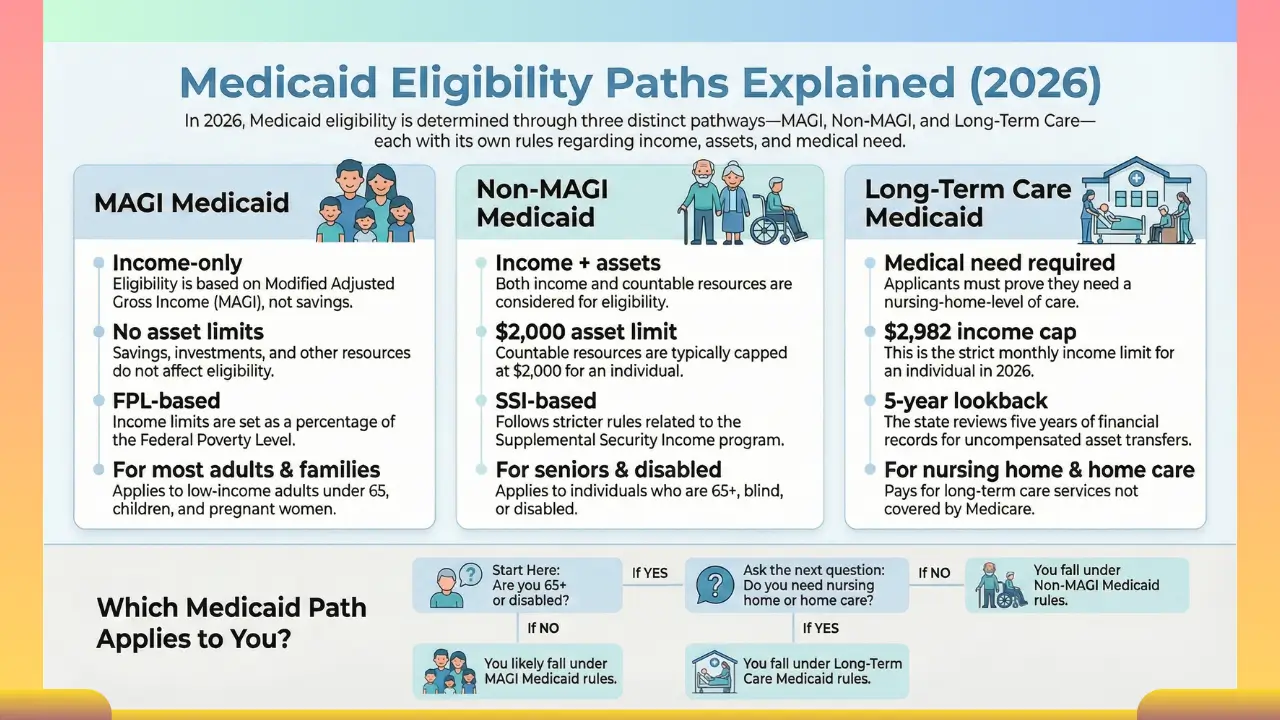

Medicaid Eligibility Paths Explained (MAGI vs Non-MAGI vs Long-Term Care)

Medicaid does not have a single set of eligibility rules. In 2026, eligibility is determined under three different rules, depending on your age, health status, and type of coverage needed.

Each path uses different income and asset rules, which is why many people are confused about whether they qualify.

But don’t worry, I am Akash Biswas (government benefits expert), and I will explain to you in a very easy way to understand all of these processes.

MAGI Medicaid (Most Adults & Families)

MAGI Medicaid is the most common form of Medicaid and applies to:

- Low-income adults under age 65

- Parents and caretaker relatives

- Children and pregnant women

- Adults in Medicaid expansion states

Eligibility is based on Modified Adjusted Gross Income (MAGI), a tax-based income calculation.

Key rules for MAGI Medicaid (2026):

- Eligibility is based on income only

- No asset or savings limits

- Income limits are set as a percentage of the Federal Poverty Level (FPL)

- Available in all states, but income limits are higher in Medicaid expansion states

This means someone can qualify for MAGI Medicaid even with significant savings, as long as their income is below the state limit.

Non-MAGI Medicaid (Seniors, Disabled, Medicare)

Non-MAGI Medicaid applies to people who are:

- Age 65 or older

- Blind or disabled

- Receiving Medicare

- Applying for Medicaid based on disability or SSI-related rules

Unlike MAGI Medicaid, this pathway uses SSI-based eligibility rules.

Key rules for Non-MAGI Medicaid (2026):

- Income and assets are both counted

- Asset limits typically cap countable resources at $2,000 for a single individual

- Savings, investments, and certain property may affect eligibility

- Rules are stricter because this pathway often connects to long-term or disability-related benefits

This is why many seniors do not qualify for Medicaid automatically, even with low income.

Long-Term Care Medicaid (Nursing Home & Home Care)

Long-Term Care (LTC) Medicaid is a subset of Non-MAGI Medicaid and pays for:

- Nursing home care

- In-home care

- Community-based long-term services (HCBS waivers)

This is the strictest eligibility category.

Key rules for Long-Term Care Medicaid (2026):

- Applicants must meet a medical need requirement, typically nursing-home-level care

- Monthly income is capped at $2,982 (300% of SSI)

- Countable assets are generally limited to $2,000

- A 5-year lookback period applies to asset transfers

- Married applicants receive spousal impoverishment protections

Because Medicare does not cover long-term custodial care, Medicaid is the primary payer — but only after strict eligibility rules are met.

Medicaid Eligibility Paths Compared (2026)

| Feature | MAGI Medicaid | Non-MAGI Medicaid | Long-Term Care Medicaid |

|---|---|---|---|

| Who it’s for | Adults & families | Seniors & disabled | Nursing home / home care |

| Income test | ✅ Yes | ✅ Yes | ✅ Yes |

| Asset limit | ❌ No | ✅ Yes | ✅ Yes |

| Typical asset cap | None | ~$2,000 | ~$2,000 |

| Income cap | FPL-based | SSI-based | $2,982/month |

| Medical need required | ❌ No | ❌ No | ✅ Yes |

| Lookback period | ❌ No | ❌ No | ✅ 5 years |

2026 Medicaid Income Limits (Updated)

Medicaid income limits for 2026 depend on which Medicaid category applies to you and your state’s rules.

There is no single income limit for everyone. Instead, Medicaid uses different standards for regular health coverage and long-term care.

What Are the Updated Income Limits for Medicaid in 2026?

- MAGI Medicaid (most adults & families):

Income is measured as a percentage of the Federal Poverty Level (FPL). In Medicaid expansion states, adults qualify up to 138% of the FPL. - Long-Term Care / Non-MAGI Medicaid:

In most states, the individual monthly income limit is $2,982 (effective January 1, 2026).

MAGI Income Limits (2026)

MAGI Medicaid applies to adults, children, and pregnant women and is based only on income, not assets.

Important 2026 note:

Until states adopt the new 2026 Federal Poverty Levels (usually by spring), early 2026 eligibility is determined using the 2025 FPL, adjusted through COLA. This is standard practice and does not reduce benefits. pasted

In Medicaid expansion states, most adults qualify with income up to 138% of the Federal Poverty Level.

2026 MAGI income limits (based on 2025 FPL):

| Household Size | 138% FPL (Expansion Adult Limit) |

|---|---|

| 1 person | $21,597 per year |

| 2 people | $29,187 per year |

| 3 people | $36,777 per year |

| 4 people | $44,367 per year |

| Each additional person | + $7,590 per year |

Expansion vs. non-expansion states

- Expansion states (40+ states & DC): Cover adults up to 138% FPL, regardless of disability or family status.

- Non-expansion states: Do not cover childless adults and often limit parents to extremely low incomes, creating a coverage gap.

Long-Term Care Income Limit (2026)

Long-Term Care Medicaid (nursing home and in-home care) uses a different income rule that is not tied to the FPL.

2026 long-term care income cap:

- $2,982 per month for an individual

- Based on 300% of the SSI Federal Benefit Rate ($994 × 3)

- Couples (both applying): $5,964 per month combined pasted

This limit applies in Income Cap states, which include large states such as Texas and Florida.

What If Your Income Is Higher Than $2,982?

What happens depends on your state:

- Medically Needy (Spend-Down) states:

There is no hard income cap. Applicants can qualify by spending excess income on medical or care expenses. - Income Cap states:

Income even $1 over the limit results in denial unless a special trust is used.

Qualified Income Trust (Miller Trust)

In Income Cap states, applicants over the income limit must use a Qualified Income Trust (QIT), also known as a Miller Trust.

A Miller Trust:

- Holds income above the Medicaid limit

- Allows applicants to qualify legally

- Must be established and managed correctly

- Requires trust funds to be used toward care costs

- Names the state as beneficiary upon death

Without a Miller Trust, long-term care Medicaid eligibility is usually not possible in income-cap states. pasted

What Is the Highest Income to Qualify for Medicaid in 2026?

- MAGI Medicaid: Depends on household size and state; for single adults in expansion states, up to $21,597 per year

- Long-Term Care Medicaid: $2,982 per month, unless a spend-down or Miller Trust is used

The next eligibility factor to consider is assets, which apply only to Non-MAGI and Long-Term Care Medicaid.

Medicaid Asset Limits for 2026 (What You Can Own)

Medicaid asset limits apply only to Non-MAGI and Long-Term Care Medicaid. If you qualify under MAGI Medicaid, there is no asset or savings limit.

For seniors, people with disabilities, and long-term care applicants, Medicaid sets strict rules on how much you can own and still qualify.

Asset Limits for Medicaid in 2026

- Single applicant:

Most Non-MAGI and Long-Term Care Medicaid programs limit countable assets to $2,000. - Married applicant (one spouse applying):

The spouse living at home (the community spouse) may keep a portion of the couple’s assets under spousal impoverishment protections.

2026 community spouse asset limits:

- Minimum protected assets: $32,532

- Maximum protected assets: $162,660

These limits are adjusted annually for inflation.

What Counts as a Medicaid Asset?

Countable assets generally include:

- Cash and checking or savings accounts

- Stocks, bonds, and mutual funds

- Certificates of deposit (CDs)

- Additional real estate (not your primary home)

- Certain life insurance cash values

If an asset can be converted to cash, Medicaid usually counts it.

What Does NOT Count as an Asset?

The following are typically exempt:

- Your primary home (subject to equity limits for long-term care)

- One vehicle used for transportation

- Personal belongings and household items

- Clothing

- Certain burial and funeral arrangements

Exempt assets do not count toward the $2,000 limit.

Home Equity Limits for Long-Term Care Medicaid (2026)

For long-term care Medicaid, a primary home is exempt only if home equity is below state limits.

2026 home equity limits:

- Minimum: $752,000

- Maximum: $1,130,000 (state-selected limit)

A home may remain fully exempt if:

- A spouse lives in the home

- A dependent or disabled child lives in the home

Why Asset Rules Matter

Asset limits are one of the most common reasons Medicaid applications are denied. Owning too much — even slightly — can result in denial unless assets are reduced or restructured in compliance with Medicaid rules.

The next consideration is how Medicaid treats asset transfers, which is especially important for long-term care applicants.

Medicaid Lookback Period & Asset Transfers (2026 Rules)

If you are applying for Long-Term Care Medicaid, Medicaid reviews your past financial activity to prevent people from giving away assets to qualify. This review is called the lookback period.

What Is the Medicaid Lookback Period?

The Medicaid lookback period is the 60 months (5 years) before the date you apply for long-term care Medicaid.

During this time, Medicaid examines:

- Gifts or transfers of money

- Property transfers

- Assets sold for less than fair market value

The lookback period does not apply to MAGI Medicaid or regular Non-MAGI Medicaid that does not involve long-term care.

What Happens If You Transferred Assets?

If Medicaid finds an improper transfer during the lookback period, it does not permanently disqualify you. Instead, Medicaid imposes a penalty period.

A penalty period means:

- Medicaid delays paying for long-term care

- You must privately pay for care during that time

- Coverage begins only after the penalty period ends

How Is the Penalty Period Calculated?

The penalty period is calculated by dividing:

The value of the transferred assets ÷ your state’s average monthly cost of nursing home care

Example:

If $60,000 was transferred and the state’s average monthly nursing home cost is $10,000, Medicaid will impose a 6-month penalty period.

There is no dollar cap on penalties — larger transfers result in longer delays.

Transfers That Are Allowed (No Penalty)

Some transfers are exempt and do not trigger a penalty, including transfers to:

- A spouse

- A disabled or blind child

- A caretaker child who lived in the home and provided care

- Certain trusts that meet federal Medicaid rules

Because these rules are specific and technical, incorrect transfers can unintentionally cause denial or delay.

Why the Lookback Period Matters

The lookback period is one of the most misunderstood Medicaid rules. Many applicants qualify financially but are denied or delayed because of a transfer they did not realize would be reviewed.

Understanding this rule early helps avoid:

- Unexpected coverage delays

- Forced private-pay periods

- Application denials that could have been prevented

How to Check Medicaid Eligibility for 2026 (Online Tools & State Websites)

You can check Medicaid eligibility for 2026 online before applying. While no tool can guarantee approval, online screening can tell you whether your income, household size, and assets are within state limits.

Can I Check Medicaid Eligibility Through My State’s Website?

Yes. Every state has an official Medicaid website that allows you to:

- Review income and asset limits

- Complete a Medicaid application

- Track application status after submission

State Medicaid sites provide the most authoritative eligibility decisions, but they can be difficult to navigate and often require completing a full application to get answers.

Checking Eligibility Through HealthCare.gov (MAGI Medicaid Only)

If you are applying for MAGI Medicaid (most adults and families), you can check eligibility through HealthCare.gov or your state’s healthcare marketplace.

HealthCare.gov:

- Screens for Medicaid eligibility automatically

- Uses income and household size

- Refers eligible applicants to the state Medicaid agency

HealthCare.gov does not determine eligibility for:

- Seniors (65+)

- Long-term care Medicaid

- Disability-based Medicaid

Using Online Medicaid Eligibility Screening Tools

Online Medicaid screening tools allow you to:

- Estimate eligibility without submitting an application

- Compare income and asset limits by state

- Identify whether MAGI, Non-MAGI, or Long-Term Care Medicaid applies

These tools are helpful for pre-screening, especially for seniors and long-term care applicants, but final eligibility decisions are always made by the state.

What Information You Need to Check Eligibility

To get an accurate estimate, you’ll need:

- State of residence

- Household size

- Monthly or annual income

- Savings and other assets (if age 65+ or applying for long-term care)

- Whether you need nursing home or in-home care

Having this information ready prevents incorrect estimates.

Important Reminder

Online tools can help you understand whether you may qualify, but they cannot:

- Approve Medicaid

- Override state rules

- Replace a formal application

Eligibility is finalized only after applying through your state Medicaid agency.

How to Apply for Medicaid Coverage in 2026

You can apply for Medicaid for 2026 at any time during the year. There is no open enrollment period for Medicaid.

Ways to Apply

You can apply:

- Online through your state’s Medicaid website

- Through HealthCare.gov (MAGI Medicaid only)

- By phone, mail, or in person at your local Medicaid office

Which Application Should You Use?

- Adults and families (MAGI Medicaid):

Apply through HealthCare.gov or your state marketplace. - Seniors, disabled, or long-term care applicants:

Apply directly through your state Medicaid agency.

What You’ll Need

When applying, be ready to provide:

- Proof of income

- Household information

- Social Security number

- Asset information (if age 65+ or applying for long-term care)

After You Apply

- Most states process applications within 30–45 days

- Long-term care applications may take longer

- You may be asked to submit additional documents

Medicaid Application Status & Tracking (2026)

After you apply for Medicaid, your state reviews your information to decide if you qualify.

How to Check Your Application Status

You can usually check your status by:

- Logging into your state Medicaid account

- Calling your state Medicaid office

- Checking your HealthCare.gov account (MAGI Medicaid only)

Some states also send updates by mail or email.

How Long Does It Take?

- Most Medicaid applications are processed in 30 to 45 days

- Disability and long-term care applications may take longer

- Missing documents are the most common cause of delays

If Your Application Is Delayed or Denied

- Review any letters from Medicaid carefully

- Submit requested documents as soon as possible

- You have the right to appeal a denial

Which Healthcare Providers Accept Medicaid in 2026?

Medicaid coverage is provided through state-approved doctors, hospitals, and clinics. Not every provider accepts Medicaid.

How to Find Providers That Accept Medicaid

You can find Medicaid providers by:

- Using your state Medicaid website

- Checking your Medicaid managed care plan’s provider directory

- Calling the doctor’s office and asking if they accept your Medicaid plan

Important Things to Know

- Provider networks vary by state and by plan

- Some doctors accept Medicaid patients only in limited numbers

- You may need to choose a primary care provider (PCP) after enrollment

Long-Term Care Providers

For nursing homes and in-home care:

- The facility must be Medicaid-certified

- Not all facilities accept new Medicaid residents

- Availability may depend on bed space and waiting lists

Medicaid Frequently Asked Questions (2026)

1. What is the income limit for Medicaid in 2026?

2. Does Medicaid count savings and assets in 2026?

3. Can I qualify for Medicaid if I own a home?

4. What is a Qualified Income Trust (Miller Trust)?

5. What is the Medicaid lookback period?

6. How do I apply for Medicaid in 2026?

7. How long does it take to get approved for Medicaid?

8. Does Medicare cover nursing home or long-term care?

Conclusion

Medicaid eligibility in 2026 depends on who you are, where you live, and what type of care you need. While many adults and families qualify based on income alone, seniors and long-term care applicants must meet stricter income, asset, and medical requirements. Understanding whether you fall under MAGI Medicaid, Non-MAGI Medicaid, or Long-Term Care Medicaid is the key to avoiding delays or denials.

Because income limits, asset rules, and application steps vary by state, checking your eligibility before applying can save time and prevent mistakes. If your situation involves Medicare, home ownership, or long-term care, reviewing the rules carefully is especially important.

Use reliable tools and official state resources to confirm your eligibility and apply with confidence under the 2026 Medicaid rules.