Wondering if you qualify for Texas Medicaid in 2025? The income limits determine your eligibility for various healthcare programs across Texas, and understanding these requirements is essential for accessing affordable medical coverage.

What you need to know about Texas Medicaid income limits:

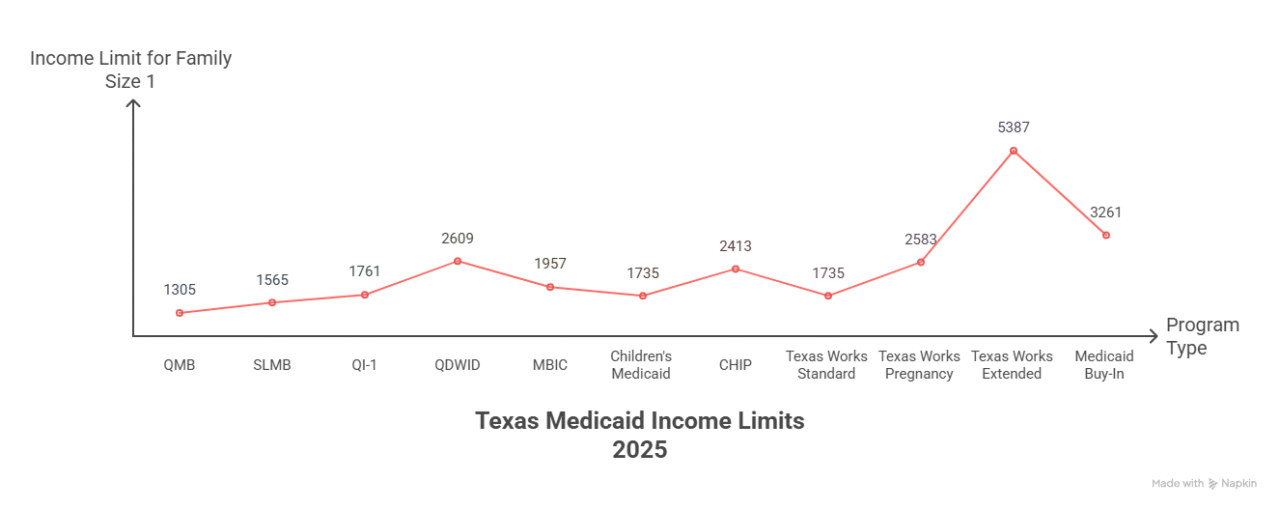

- Monthly income limits range from $1,305 to $5,387 depending on program type

- Family size directly impacts qualification amounts

- 2025 limits increased based on Federal Poverty Level updates

- Different programs serve children, seniors, disabled individuals, and families

- Coverage became effective March 1, 2025

- Calculate your Texas Medicaid eligibility here

Understanding Texas Medicaid Income Limits 2025

Texas Medicaid income limits are monthly income thresholds that determine who qualifies for state-funded healthcare programs.

The Texas Health and Human Services Commission sets these limits annually using Federal Poverty Level guidelines.

Each Medicaid program targets specific populations with unique income requirements. These range from 100% of the Federal Poverty Level for basic coverage to 413% for specialized programs.

Complete Texas Medicaid Income Limits Table 2025

| Program Type | Target Population | Family Size 1 | Family Size 2 | Family Size 3 | Family Size 4 | FPL % |

|---|---|---|---|---|---|---|

| Medicare Savings Programs | ||||||

| QMB | Medicare beneficiaries | $1,305 | $1,763 | – | – | 100% |

| SLMB | Medicare beneficiaries | $1,565 | $2,115 | – | – | 120% |

| QI-1 | Medicare beneficiaries | $1,761 | $2,380 | – | – | 135% |

| QDWI | Disabled workers | $2,609 | $3,525 | – | – | 200% |

| Children’s Programs | ||||||

| MBIC | Children with disabilities | $1,957 | $2,644 | $3,332 | $4,019 | 150% |

| Children’s Medicaid | Children in families | $1,735 | $2,345 | $2,954 | $3,564 | 133% |

| CHIP | Children | $2,413 | $3,261 | $4,109 | $4,957 | 185% |

| Adult & Family Programs | ||||||

| Texas Works Standard | Adults and families | $1,735 | $2,345 | $2,954 | $3,564 | 133% |

| Texas Works Pregnancy | Pregnant women | $2,583 | $3,490 | $4,398 | $5,305 | 198% |

| Texas Works Extended | Special populations | $5,387 | $7,280 | $9,173 | $11,065 | 413% |

| Buy-In Programs | ||||||

| Medicaid Buy-In | Working disabled | $3,261 | – | – | – | 250% |

All amounts are monthly income limits effective March 1, 2025. For families larger than 4, contact Texas Health and Human Services for specific limits.

Medicare Savings Programs Income Limits 2025

Medicare Savings Programs help Texas residents pay Medicare premiums and costs. Here are the current monthly income limits:

Qualified Medicare Beneficiaries (QMB)

Income Limit: 100% Federal Poverty Level

- Individual monthly limit: $1,305

- Married couple monthly limit: $1,763

- Deeming amount: $458

This program covers Medicare Part A and B premiums, deductibles, and coinsurance.

Specified Low-Income Medicare Beneficiaries (SLMB)

Income Limit: 120% Federal Poverty Level

- Individual monthly limit: $1,565

- Married couple monthly limit: $2,115

- Deeming amount: $550

SLMB covers Medicare Part B premiums only.

Qualifying Individuals Program (QI-1)

Income Limit: 135% Federal Poverty Level

- Individual monthly limit: $1,761

- Married couple monthly limit: $2,380

- Deeming amount: $619

Limited funding program covering Medicare Part B premiums on first-come, first-served basis.

Qualified Disabled Working Individuals (QDWI)

Income Limit: 200% Federal Poverty Level

- Individual monthly limit: $2,609

- Married couple monthly limit: $3,525

- Deeming amount: $916

Covers Medicare Part A premiums for disabled individuals who lost free Part A due to work.

Medicaid Buy-In Programs 2025

Standard Medicaid Buy-In (MBI)

Working individuals with disabilities can maintain Medicaid coverage with higher incomes:

- Monthly income limit: $3,261 (250% Federal Poverty Level)

- Premium payments required based on income level

- Allows asset accumulation while maintaining healthcare coverage

Medicaid Buy-In for Children (MBIC)

Children with disabilities can qualify at 150% Federal Poverty Level:

| Family Size | Monthly Income Limit |

|---|---|

| 1 person | $1,957 |

| 2 people | $2,644 |

| 3 people | $3,332 |

| 4 people | $4,019 |

| 5 people | $4,707 |

| 6 people | $5,394 |

| 7 people | $6,082 |

| 8 people | $6,769 |

Add $687 for each additional family member beyond 8 people.

Texas Works Medical Programs Income Chart

Texas Works provides Medicaid coverage for families through various assistance categories:

| Family Size | 133% FPL | 185% FPL | 198% FPL | 413% FPL |

|---|---|---|---|---|

| 1 | $1,735 | $2,413 | $2,583 | $5,387 |

| 2 | $2,345 | $3,261 | $3,490 | $7,280 |

| 3 | $2,954 | $4,109 | $4,398 | $9,173 |

| 4 | $3,564 | $4,957 | $5,305 | $11,065 |

| 5 | $4,173 | $5,805 | $6,213 | $12,958 |

| 6 | $4,783 | $6,653 | $7,120 | $14,851 |

Different assistance types (TP and TA codes) correspond to specific income levels and target populations.

Children’s Medicaid and CHIP Income Requirements

Children’s Medicaid: Covers children in families earning up to 133% Federal Poverty Level CHIP (Children’s Health Insurance Program): Serves families earning too much for Medicaid but unable to afford private insurance

Income limits vary by family size and specific program category. Most children qualify through MAGI-based calculations that consider tax household composition.

How Texas Calculates Medicaid Eligibility

Texas uses Modified Adjusted Gross Income (MAGI) methodology for most Medicaid programs:

Counted Income Sources:

- Wages and salary

- Self-employment earnings

- Social Security benefits (if taxable)

- Investment and interest income

- Retirement account distributions

- Unemployment compensation

Income Disregards: Texas applies a 5% Federal Poverty Level disregard to most applications. This effectively raises income limits by approximately $65-$387 monthly depending on family size.

Asset Limits and Considerations

Most MAGI-based Texas Medicaid programs do not impose asset limits. However, certain programs for elderly and disabled individuals maintain resource requirements:

- Individual asset limit: $2,000

- Married couple asset limit: $3,000

- Community spouse protection: Up to $157,920

When New Income Limits Apply

The 2025 Texas Medicaid income limits became effective March 1, 2025. Texas automatically updated active cases using new amounts.

Coverage Period Rules:

- March 2024 through February 2025: Apply 2024 income limits

- March 2025 through February 2026: Apply 2025 income limits

- Split period applications: Use appropriate limits for each coverage month

Application Process and Documentation

To apply for Texas Medicaid with the 2025 income limits:

Required Documentation:

- Pay stubs or employment verification

- Tax returns or tax transcripts

- Social Security benefit statements

- Bank statements

- Proof of identity and Texas residency

Application Methods:

- Online through YourTexasBenefits.com

- In-person at local Health and Human Services offices

- By mail or fax with completed application forms

Frequently Asked Questions

What is the income limit for Medicaid in Texas for a family of 4 in 2025?

About $3,564/month (133% FPL), but higher if pregnant or applying for children.

What if my income exceeds the limit by a small amount?

Texas applies a 5% income disregard that may help you qualify even if your gross income appears over the limit. Medical expenses may also reduce countable income.

Do seniors on Medicare qualify for Medicaid in Texas?

Yes, through Medicare Savings Programs (QMB, SLMB, QI-1, QDWI) if income is within limits.

Do temporary income increases affect my eligibility?

Texas averages your expected annual income over 12 months. Temporary increases may not disqualify you if your average stays within limits.

Can college students qualify for Texas Medicaid?

Yes, if they meet income requirements and other eligibility criteria. Student financial aid may or may not count as income depending on the type.

Can working parents qualify for Texas Medicaid?

Yes, but income limits are low. Many working parents instead qualify for CHIP for their kids.

How do I apply for Medicaid in Texas?

You can apply online at YourTexasBenefits.com, by phone, or in person at HHSC offices.

Maximizing Your Chances for Approval

Tips for Texas Medicaid Applications:

- Apply early in the month for faster processing

- Gather all required documents before starting your application

- Report income accurately using current amounts, not outdated figures

- Include all household members who must file taxes together

- Follow up on your application status regularly

Conclusion

Texas Medicaid income limits for 2025 provide pathways to healthcare coverage for individuals and families across various income levels. With limits ranging from $1,305 for basic Medicare assistance to $11,065 for larger families, these programs ensure access to medical care for eligible Texans.

Understanding which program fits your situation and income level is crucial for successful enrollment. Whether you need coverage for children, Medicare assistance, or family healthcare, the 2025 income limits offer expanded opportunities compared to previous years.

Start your application process early and ensure you have all required documentation. Contact your local Texas Health and Human Services office or visit YourTexasBenefits.com to begin your application using the current income guidelines.